Vendor Management Software Market Trends, Share & Forecast | 2035

A detailed analysis of the Vendor Management Software Market Growth Share by Company reveals a significant market shift, with growth being disproportionately captured by cloud-native platforms that prioritize user experience and by specialized solutions that address the increasingly critical areas of risk and contingent workforce management. While the traditional ERP giants still command a massive revenue base from their long-standing enterprise customers, the majority of net-new market growth is being seized by more agile and focused competitors. The companies experiencing the fastest growth are those that have successfully transformed vendor management from a back-office, administrative function into a strategic, front-line business process. This involves providing tools that are not just powerful, but are also easy to use for all employees involved in the procurement lifecycle, from the sourcing professional to the individual employee making a purchase request. This focus on a consumer-grade user experience has been a major differentiator and a key driver of market share gains.

The most significant growth driver in the market is the increasing focus on third-party risk management. In today's interconnected world, a company's risk exposure extends far beyond its own four walls to its entire ecosystem of suppliers and vendors. High-profile data breaches originating from a third-party vendor, supply chain disruptions, and new ESG (Environmental, Social, and Governance) compliance requirements have elevated vendor risk management from a secondary concern to a board-level imperative. This has created a massive growth opportunity for software providers who can offer robust solutions for onboarding vendors, conducting due diligence, continuously monitoring their risk posture (for cybersecurity, financial stability, and compliance), and managing performance. Companies with strong capabilities in this third-party risk management (TPRM) space are seeing explosive growth as businesses scramble to gain visibility and control over their extended enterprise risk landscape.

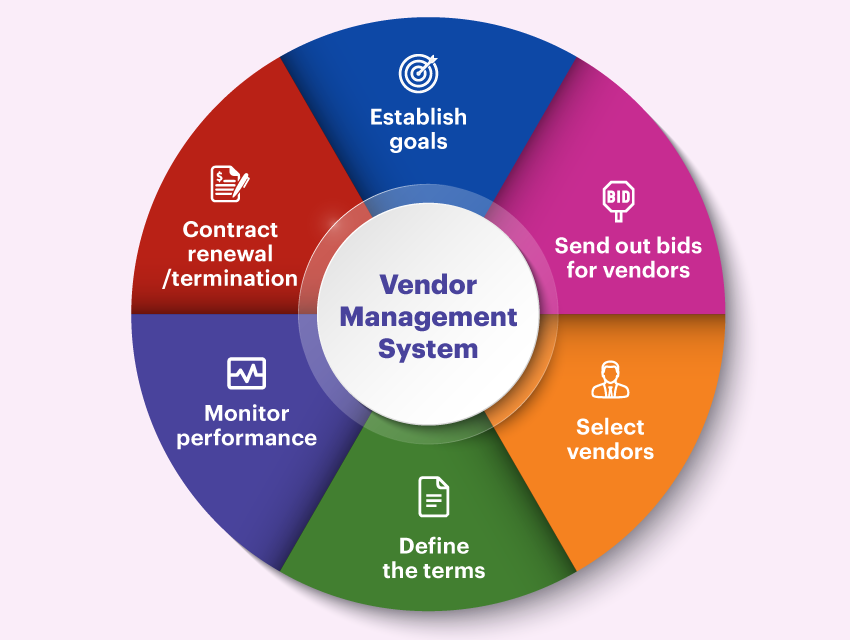

Another major area of growth is in the specialized segment of managing the contingent or "extended" workforce. As companies increasingly rely on a flexible workforce of contractors, freelancers, and temporary staff to augment their full-time employees, the need for a dedicated system to manage this complex talent pool has become critical. The traditional Vendor Management System (VMS) providers, like SAP Fieldglass and Beeline, have dominated this space and continue to capture significant growth as this trend accelerates. Their platforms provide a complete, end-to-end workflow for sourcing, onboarding, managing time and expenses, and paying contingent workers, providing enterprises with much-needed visibility and control over this significant and often unmanaged category of labor spend. The growth in the "gig economy" and the broader shift towards more agile staffing models is a powerful and durable tailwind for this segment of the market. The Vendor Management Software Market size is projected to grow to USD 55.17 Billion by 2035, exhibiting a CAGR of 11.18% during the forecast period 2025-2035.

Top Trending Reports -

Universal Flash Storage Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness